Design to Impress, Develop to performDesign to Impress, Develop to perform

Top 5 Wealth Management Software Development Companies in London, UK

Wealth management is a critical measure in securing long-term financial stability, future growth, and investment optimization. Whether you are managing wealth for yourself or your family, there are many challenges that one must consider. Gone are the days when managing wealth was tedious. Technology has made things easier. With the right investment in the development of wealth management software, one can attain plenty of ease.

However, the big question in your mind is – who to choose for your FinTech software development. Comparing the top companies, checking their portfolio, and consulting with every one of them can be hard. To simplify things, we are here with the list of top 5 wealth management software development companies London for a quick pick.

By comparing the below given top names, their work, features, deadlines, and quotations, things are going to be way easier. But before knowing the top names, let's know a few key reasons why choose fintech software development firms and their advantages.

Reasons to Hire Wealth Management Software Development Companies London

London has been making waves in the fintech industry for many years. With leading-edge software development, up-to-date norms, and excellent after-sale services, finding the best talent is easier in London.

1. Deep Financial Industry Expertise

Fintech companies in London are hubs for Europe's financial industry and they often collaborate with top-tier banks, investment firms, and fintech distributors for wealth management workflow. With such expertise in wealth management, you can't find this remarkable niche expertise anywhere else.2. Proven Regulatory Compliance

Due to the strictest financial regulation in the UK, wealth management software development companies UK are well-versed with MiFID II, GDPR, FCA, and PSD2 guidelines. These companies will understand your requirements better and you will have negligible legal risks along with built-in compliance features.3. Access to World-Class Talent and Innovation

With top-tier education faculties and world-class talent in one place, you will get top developers, UX designers, fintech architects, and data scientists to work on your project ensuring modern, scalable, and secure software.Top 5 Wealth Management Software Development Companies UK

Finding the best talent is hard, but not if you have the list of top 5 software development firms in the UK leading the way in wealth management innovation. Let's get started by knowing the top names and how to find the right one for your needs.

1. Solusent

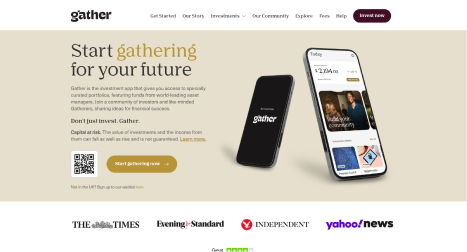

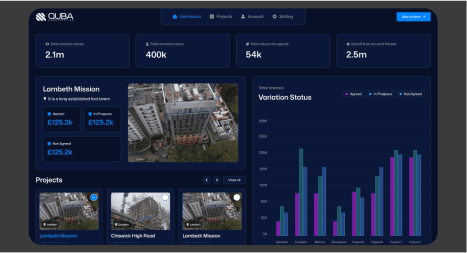

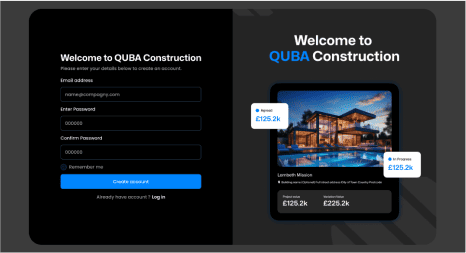

Ideal for: Financial firms, startups, and accounting-led wealth platforms seeking innovative, modular solutions with rapid delivery.Solusent is a renounced name in the list of top wealth management software development companies London. Solusent is known for creating innovative, secure, and efficient financial technology solutions. From the development of a custom wealth tech platform to the fintech accounting system, Solusent is a perfect choice considering the number of positive reviews, a strong portfolio, and their demand.

Key Features:

- Custom WealthTech Platform Development

- Fintech Accounting System Integration

- Client-Centric Financial Dashboards

- Investment Tracking and Reporting Tools

- Secure Cloud-Based Infrastructure

2. Intellectsoft

Ideal for: Wealthtech startups, digital-first investment firms, innovation-driven financial advisors, and companies exploring blockchain or AI in financial servicesIntellectsoft is a popular name that develops intelligent wealth management platforms with AI, blockchain, and cloud computing capabilities. Intellectsoft’s Fintech firm is capable of making top-tier wealth management programs with customization, smart features, cross-platform functionality, and more.

Key Features:

- Smart asset allocation and rebalancing tools

- Cross-platform mobile and web development

- AI and machine learning for predictive insights

- Blockchain-based ledger solutions for security

- Risk tolerance analysis modules

3. BJSS

Ideal for: Banks, private wealth management firms, HNW portfolio managers, and enterprise clients needing robust and compliant digital platforms.BJSS is a UK-based IT consultancy known for delivering enterprise-grade financial software solutions. They have deep experience working with major banks and wealth managers, focusing on digital transformation, innovation, and compliance in financial applications.

Key Features:

- Modular wealth management architecture

- Client onboarding and CRM integrations

- Secure cloud deployment (Azure, AWS)

- Real-time investment tracking & analytics

- Performance and tax reporting tools

4. Andersen

Ideal for: Fintech startups, online wealth advisors, digital financial planners, and fast-scaling investment platforms needing robust technology stacks.Andersen is one of the most popular Wealth Management Software Development Companies UK with deep expertise in fintech and banking. Their London-based operations offer comprehensive wealth management software tailored to automate and enhance digital advisory services.

Key Features:

- Multi-tier wealth management systems

- Robo-advisory development

- Real-time risk assessment tools

- Financial planning and goal-setting modules

- Integrated KYC/AML compliance features

5. DataArt

Ideal for: Established investment firms, digital banks, portfolio management companies, and financial institutions seeking scalable, enterprise-grade solutions.DataArt is a global software engineering firm with a strong presence in London. They develop custom wealth and asset management platforms tailored to modern financial institutions, ensuring compliance, scalability, and seamless integrations.

Key Features:

- End-to-end wealth management platform development

- Custom portfolio management tools

- Integration with trading platforms and custodians

- AI-driven investment analytics

- Secure data storage and compliance with MiFID II, GDPR

- Advanced reporting and client dashboards

Things to Consider For Wealth Management Software Development Companies UK

By focusing on five key criteria, making a decision during the selection of the right fintech software development companies will be easier. Consider the following:

1. Industry Experience

Finding firms based on the number of years in the software development industry can be a wild move. Instead focus on companies with portfolios in wealth management and compare the options based on years after that.2. Technology Stack

With the fast world, technology in web development, software, and app developments have changed in the last few years. Choosing a wealth management software development firm that provides modern means of software development for frontend and backend technology will be a better option.3. Post-Launch Support

Many big names in the industry offers great software development for affordable price. However, after the software launches, many businesses face issues with after-sale or post-launch support from the same firm. So, always keep this in mind to cross-check about after-sale support.4. Security and Compliance

When choosing a wealth management software development firm, it is essential to ensure they prioritize security and regulatory compliance. Look for firms that adhere to key financial regulations such as GDPR, MiFID II, and PSD2. These frameworks govern how financial data is handled, stored, and transmitted, helping to protect client privacy and reduce legal risks.5. Client Reviews and Case Studies

Considering feedback from other customers on the Google review page is one of the best ways to ensure the quality of services. By checking the real-world success stories of a brand, making the decision will be easier.During the conversation with a development company, always ask for a detailed tech stack proposal to cross-check with your company size, growth plans, regulatory needs, and user expectations to ensure you are getting what you want.

The firms listed above bring a blend of financial know-how and tech innovation to help you stay competitive in a digital-first world. Understanding your company’s specific needs based on all the key aspects will let you figure out the best wealth management software development companies UK. If you're planning to digitize your wealth management services, consider booking consultations with a few of these companies to find the best fit.