Design to Impress, Develop to performDesign to Impress, Develop to perform

Fintech & Accounting in London

Beautiful solutions with stunning Fintech & Accounting

3

133

346

We are a leading fintech development agency based in London. We specialize in creating innovative, secure, and efficient financial technology solutions tailored to meet the unique needs of businesses. Our team of experts leverages cutting-edge technology to deliver high-quality, scalable products.

Discovery & Design

Development

Testing & Deployment

Quality Assurance (QA) Testing:

- Automated and Manual Testing: We conduct extensive automated and manual testing to ensure the product functions correctly and meets all requirements. This includes unit, integration, and end-to-end testing to identify and resolve any issues.

Security and Performance Testing:

- Security Testing: Our team performs thorough security testing, including penetration testing and vulnerability scanning, to identify and fix vulnerabilities, ensuring the protection of sensitive financial data.

- Performance Testing: We assess the product’s performance under various conditions to ensure it can handle expected user loads and stress conditions without compromising speed or reliability.

Compliance and Regulatory Testing:

- Regulatory Compliance Checks: We verify that the product complies with relevant financial regulations and standards, such as GDPR, PSD2, and AML/KYC requirements, ensuring proper data handling, storage, and security measures are in place.

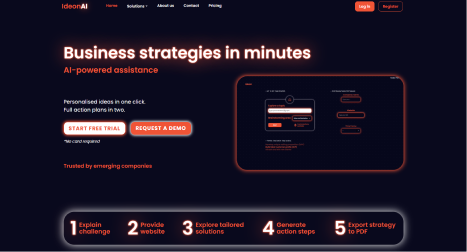

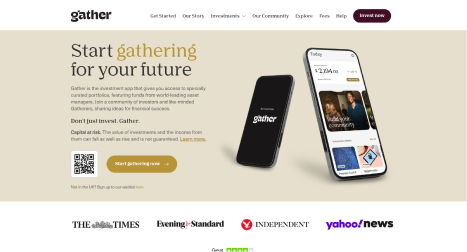

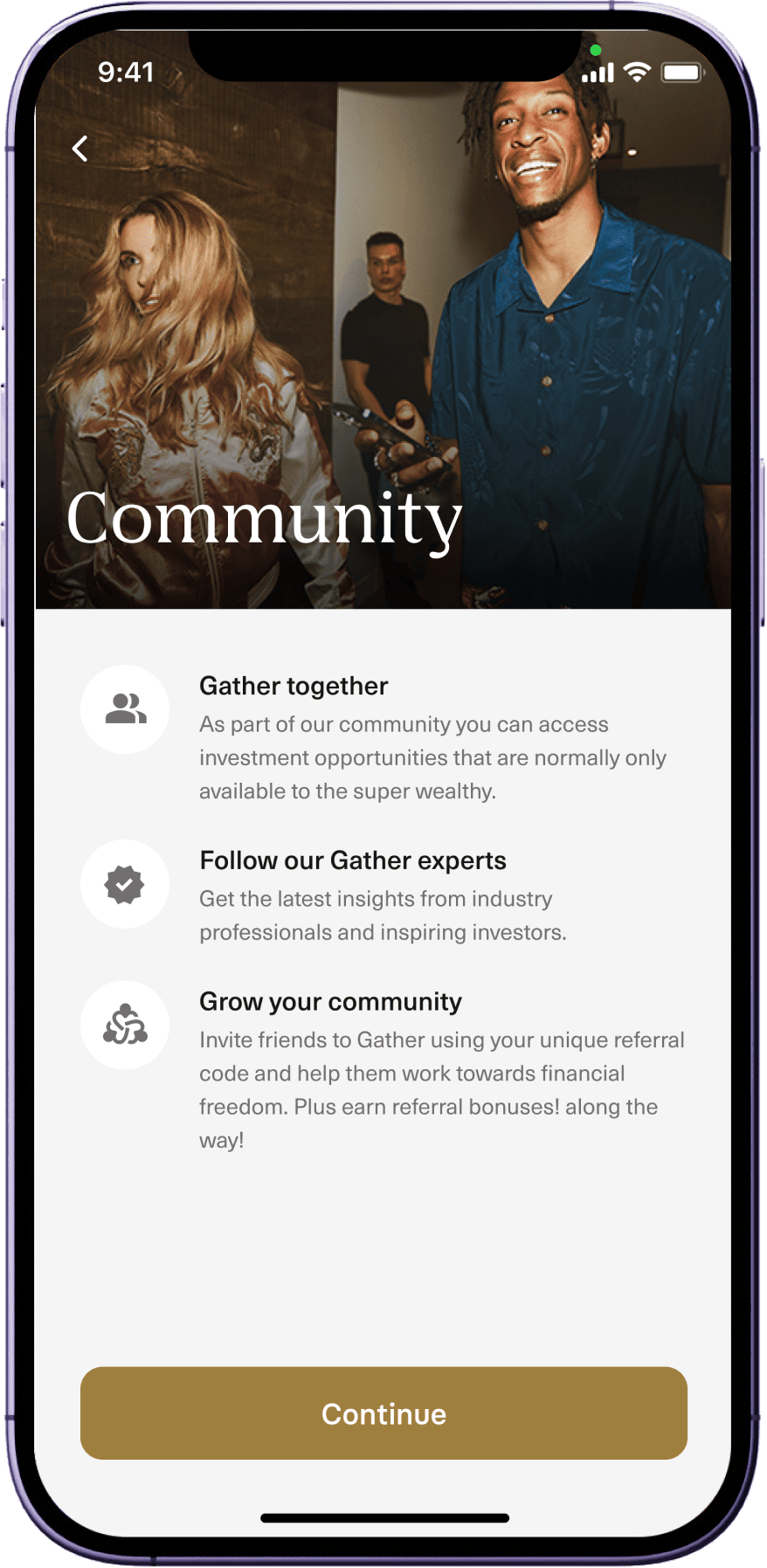

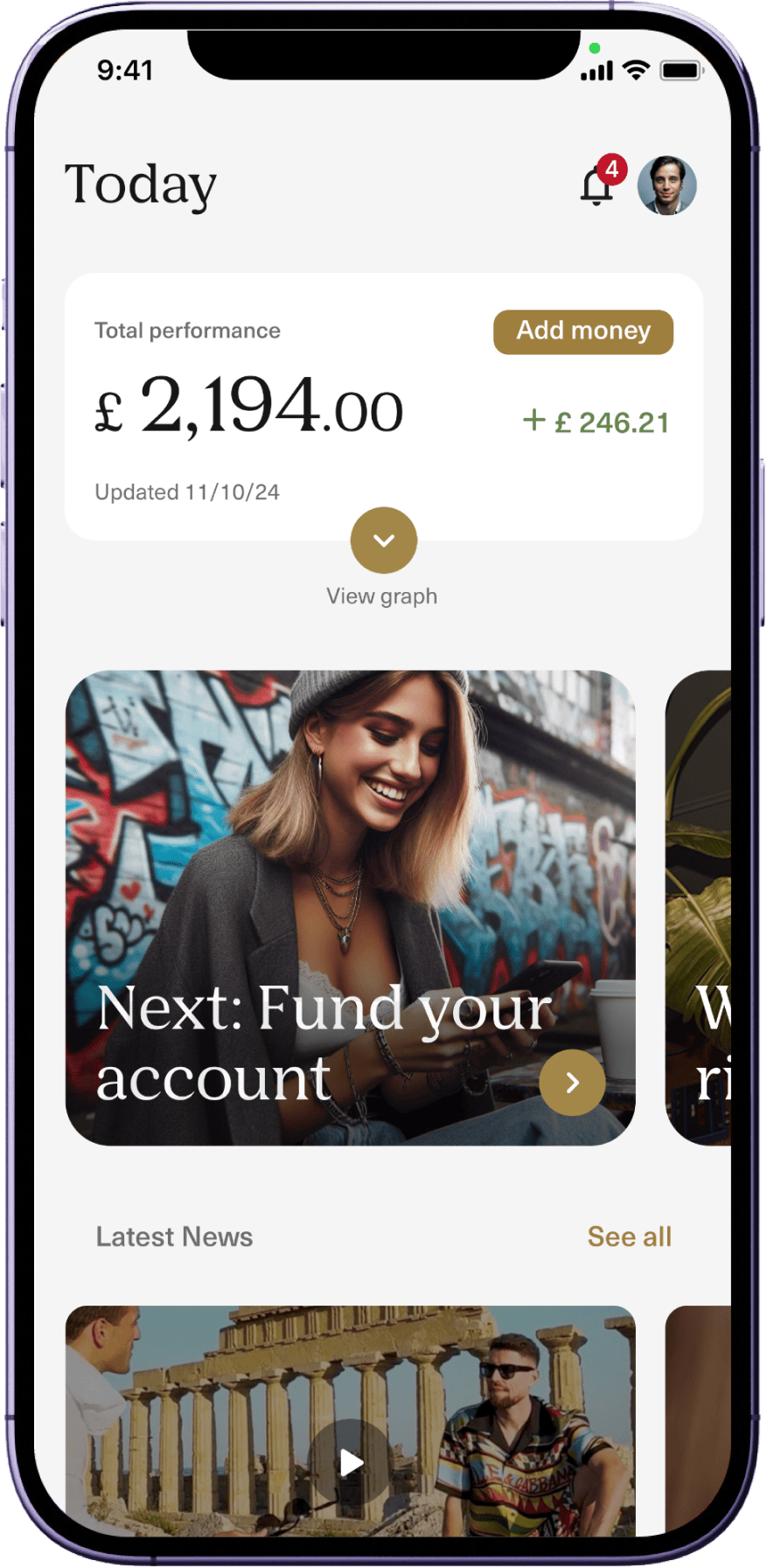

Gather

A collaborative development process between our development team and Gather, a fintech startup, to create an innovative investing app.

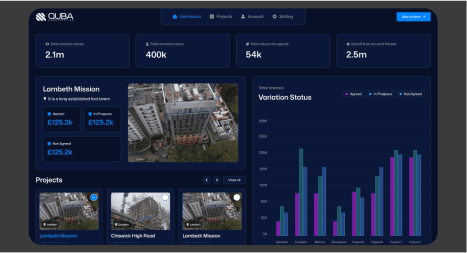

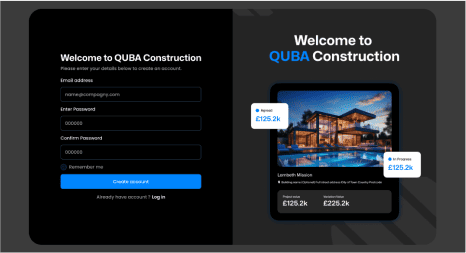

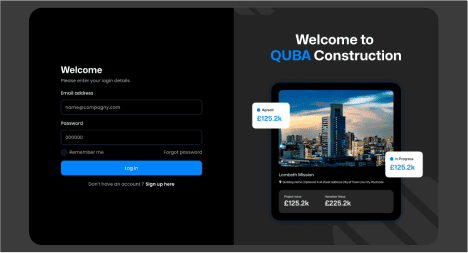

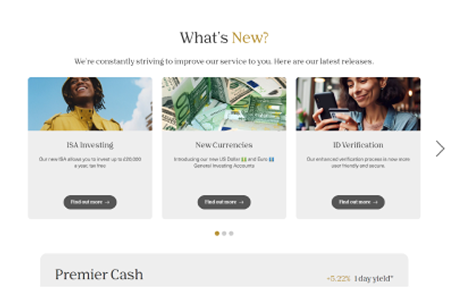

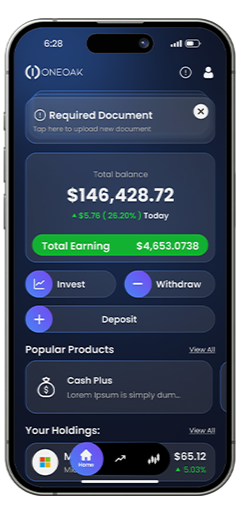

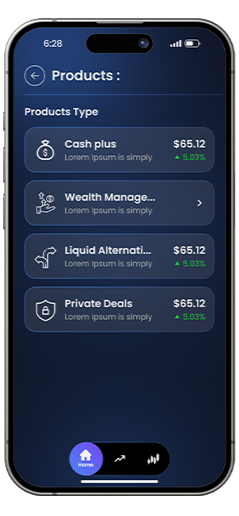

One Oak

1OAK Wealth Management is a leading financial advisory firm offering personalized wealth management solutions to high-net-worth individuals and institutional clients.

Our Fintech expertise

1. Custom Fintech Software Development

- We create tailored financial technology solutions to meet your unique business needs, ensuring innovative and effective results.

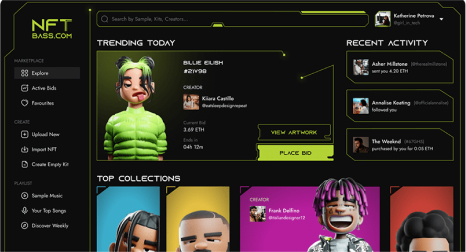

2. Blockchain and Smart Contract Development

- Our team designs secure, transparent blockchain solutions and smart contracts to automate transactions and enhance security.

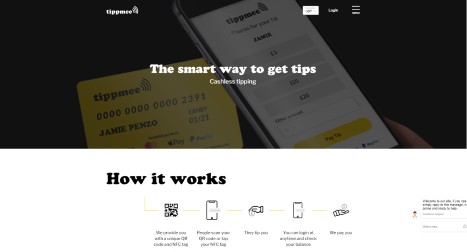

3. Payment Gateway Integration

- We provide seamless integration with various payment gateways, facilitating secure and efficient transactions for your business.

4. Digital Wallet Development

- We develop secure digital wallets for storing and managing cryptocurrencies, ensuring convenience and safety for your users.

5. Regulatory Compliance Solutions

- Our services ensure your fintech product complies with industry regulations like GDPR, PSD2, and AML/KYC, safeguarding your business from legal risks.

FAQ

What are fintech development services?

Fintech development services involve creating software solutions for the financial sector. This includes developing applications for banking, payments, investments, lending, and more, using technologies like blockchain, ai, and machine learning.

How can fintech solutions benefit my business?

Fintech solutions can streamline operations, enhance security, improve customer experience, and provide valuable insights through data analytics. They can also reduce costs by automating processes and eliminating intermediaries.

What is involved in developing a fintech application?

Developing a fintech application involves several stages: discovery and planning, ux/ui design, development, testing, deployment, and maintenance. Each stage ensures the app is functional, secure, user-friendly, and compliant with regulations.

How do I choose the right fintech development company?

Choose a fintech development company with a strong portfolio, expertise in relevant technologies, a good understanding of financial regulations, and positive client testimonials. Ensure they offer comprehensive services from consulting to post-launch support.

How much does it cost to develop a fintech app?

The cost of developing a fintech app varies based on complexity, features, technology stack, and development time. It can range from a few thousand to several hundred thousand dollars. It's best to get a detailed quote from a development company.

How do you ensure the security of a fintech application?

We ensure security through rigorous testing, including penetration testing and vulnerability scanning. We implement encryption, secure coding practices, and comply with industry standards and regulations to protect sensitive financial data.

What regulations must a fintech application comply with?

Fintech applications must comply with various regulations such as gdpr for data protection, psd2 for payment services, and aml/kyc for anti-money laundering and customer identification. Compliance depends on the specific services and regions involved.

Can you integrate blockchain technology into my fintech app?

Yes, we can integrate blockchain technology to enhance security, transparency, and efficiency. Blockchain can be used for secure transactions, smart contracts, digital identity verification, and more within your fintech app.

What is the typical timeline for developing a fintech product?

The timeline for developing a fintech product varies depending on the complexity and scope of the project. On average, it can take anywhere from 3 to 12 months, encompassing stages like planning, design, development, testing, and deployment.